What is KuCoin?

KuCoin is an extremely popular cryptocurrency exchange with over 30 million users worldwide. It was launched in 2017, marketed as 'The People's Exchange', with an aim to give users around the world access to a safe platform for trading 700+ cryptocurrencies.

Many traders are attracted to KuCoin's low trading fees, with spot trading fees at 0.1%, and futures trading fees only 0.02/0.06% (maker/taker). You can lower trading fees by 20% when you pay with KCS coin, and high volume traders receive additional discounts. KuCoin users enjoy various ways to trade, such as spot trading, margin trading, P2P, and bot trading. The platform is also packed with other features such as crypto borrowing, lending, staking, and an NFT marketplace.

My Overall Thoughts on KuCoin

KuCoin's range of services and coins is impressive, making it extremely popular around the world. With low trading fees, a wide range of markets, and an abundance of trading tools available, there's no wonder that more than 30 million crypto traders use KuCoin. These are my personal top 3 reasons why I use KuCoin:

1) The trading fees on KuCoin are extremely low. For spot trading, the fees are 0.1% and you can reduce this fee to 0.08% if you pay fees using KCS coin. For futures trading, fees are even lower, at 0.02% for makers and 0.06% for takers. If you prefer to buy and sell crypto on the P2P marketplace, there are zero fees incurred!

2) KuCoin has over 700+ cryptocurrencies to trade on the market, one of the widest ranges available, and they continually add new coins to their list. You will almost certainly find the coin you wish to trade on KuCoin.

3) KuCoin has an extensive array of additional features that aren't found on basic crypto exchanges. Experienced crypto traders and investors will enjoy margin trading, spot trading, P2P marketplace, futures trading and earning crypto interest with crypto lending and staking.

One criticism of KuCoin is that you can't withdraw fiat currency directly from the exchange. However, there is a simple way to withdraw your money by transferring your crypto to another exchange first, as shown in my step-by-step guide here.

Overall, if you are after low trading fees, plenty of features, and over 700+ different cryptocurrencies, KuCoin is the exchange for you.

Key Features & Advantages of KuCoin

KuCoin has grown to be one of the largest cryptocurrency exchanges in the world, and that is mainly due to the wide range of services on offer. From my experience using KuCoin, these are what I found to be the best features:

Negatives & Disadvantages of KuCoin

KuCoin is an excellent choice for a lot of crypto traders, but these are a couple of downsides you may want to consider before you sign up on this exchange.

What Services Does KuCoin Offer?

If you have been researching crypto exchanges lately, you will know that there are plenty of options in 2024. It can be difficult to decide which one to use, so I strive to provide the most detailed reviews from my years of personal experience to help you make the right choice. Let's have a look at what KuCoin offers their users, and what I think of each feature.

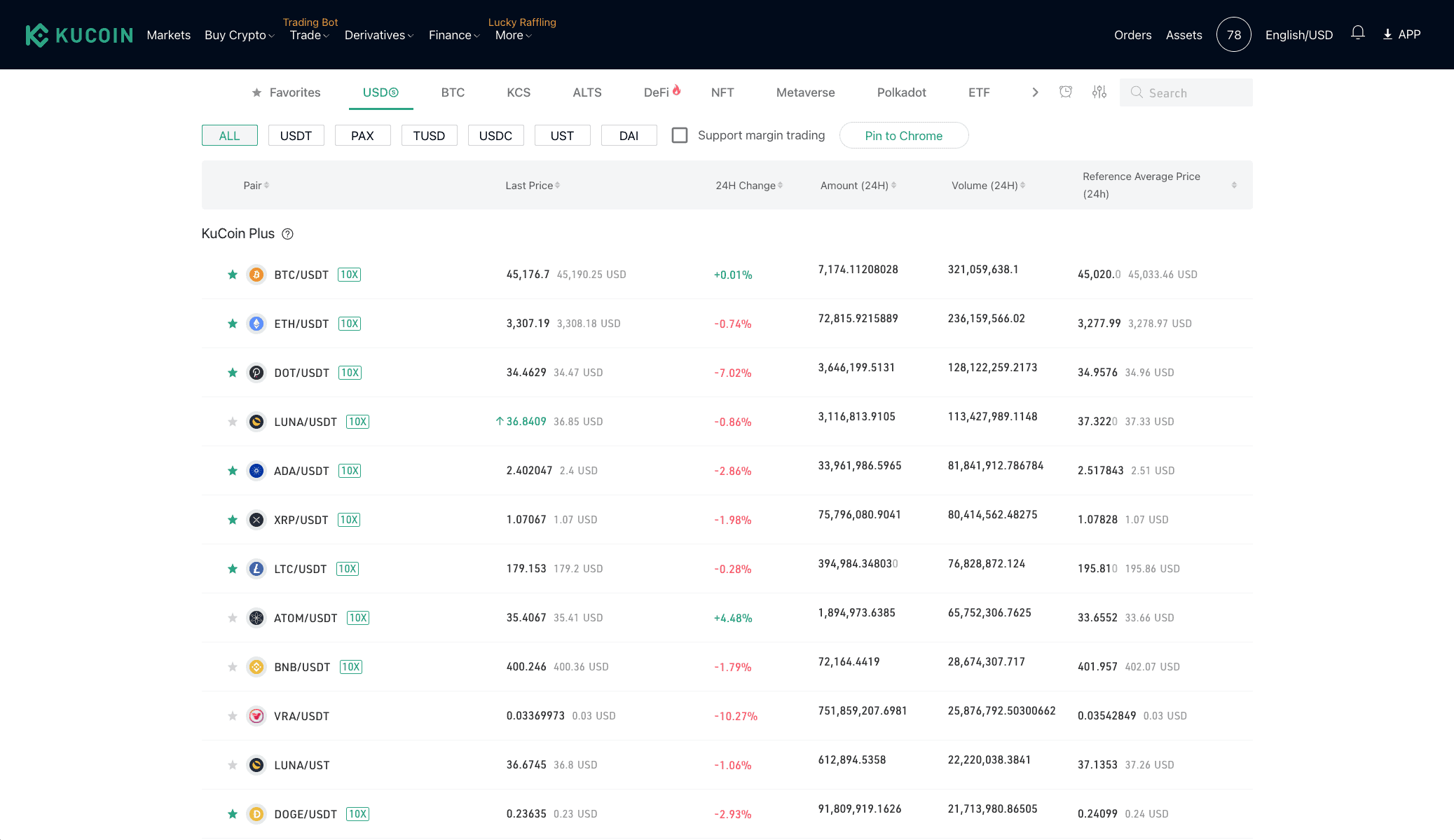

Over 700+ different cryptocurrencies: KuCoin has a huge range of over 700+ cryptocurrencies, which is among the most I have seen on any exchange. KuCoin also regularly adds new coins to their platform so their users can be the first to trade new cryptocurrencies.

I had a thorough look at KuCoin and found that while there are 700+ coins available on the market, they are not all available to buy instantly. If you want to buy crypto directly using fiat currency, there are only about 60 popular coins available. To buy the other coins on the platform, you need to trade on the market.

USDT is a popular stablecoin that is pegged to the US Dollar, meaning 1 USDT = 1 USD. The most common way to buy a coin that isn't available for direct purchase is to buy USDT with fiat currency, then trade USDT for the crypto of your choice.

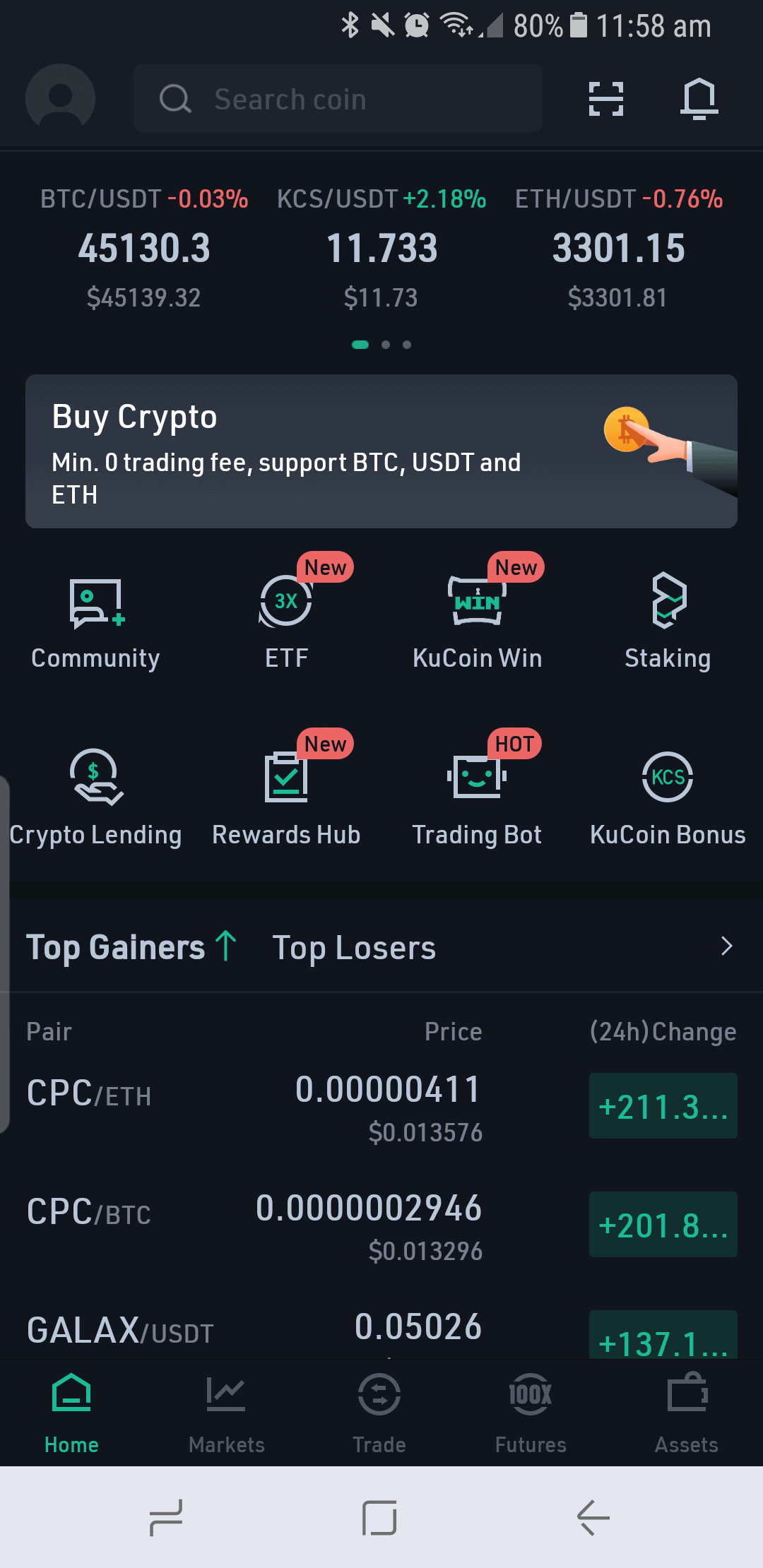

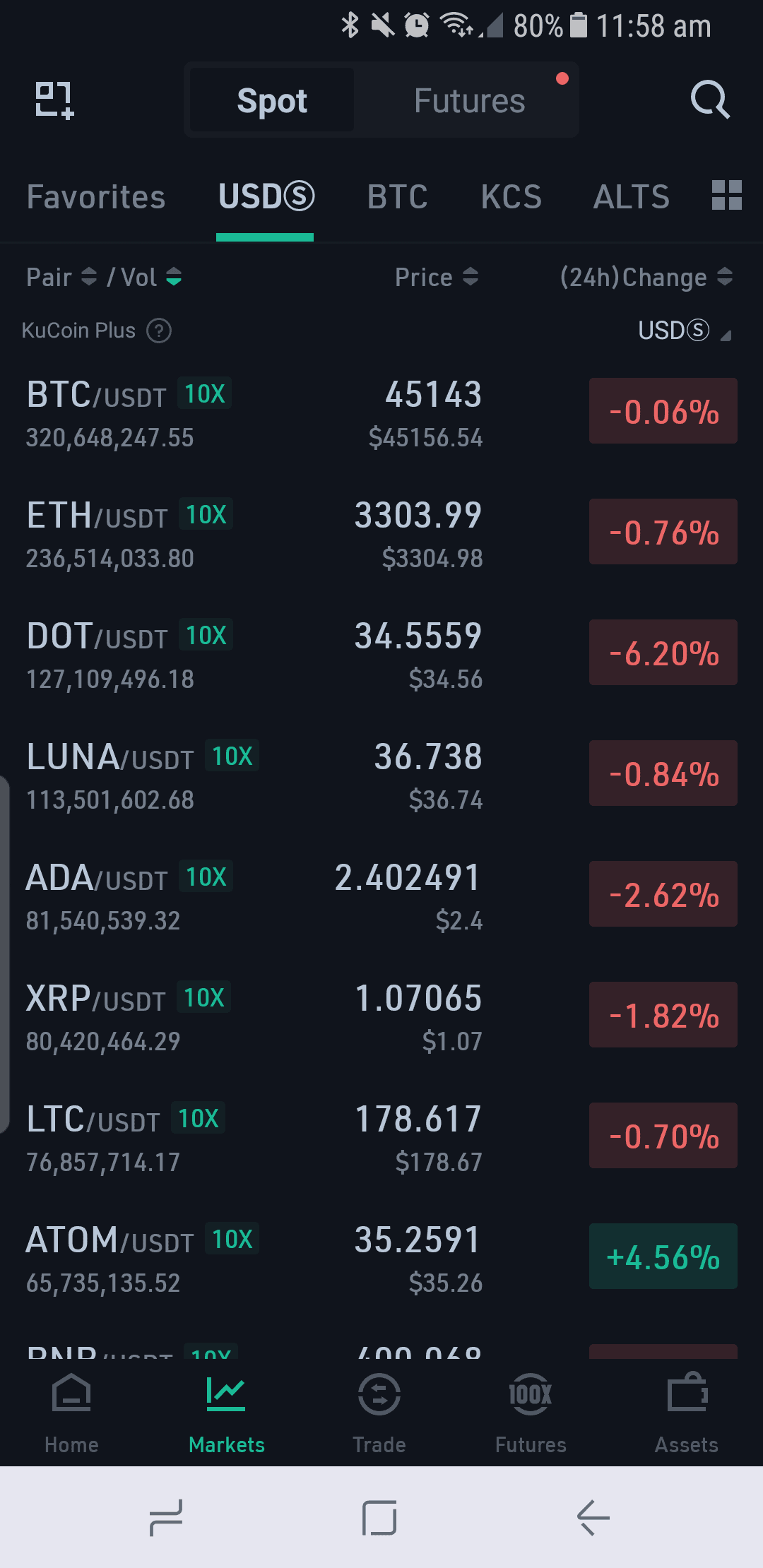

Mobile app for iOS and Android: KuCoin has an app available for iOS and Android devices, so you can watch the markets, track your portfolio, and trade at any time. I installed the app on my Samsung Galaxy to test it out, and found the interface to be sleek, with everything optimized for mobile, making it easy to read charts and prices.

I tested out various features, such as automatic trading bots, futures trading, spot trading, and staking, and they were all accessible and worked smoothly. There were no issues or lag detected at all during the hour we tested the app.

You can see the popularity of KuCoin's app when you visit the Google Play store, with more than 10 million downloads and a high user review rating of 4.5 stars from 183,000 reviews at the time of writing.

Buy crypto directly with fiat currencies: While KuCoin is primarily a trading platform, it does offer a fiat gateway so you can buy crypto directly. I tested it out, and the entire process was really simple, with the transaction complete in under a minute. All you need to do is choose how much fiat currency you want to spend (50+ currencies supported), select the crypto asset you wish to buy, and finalize the transaction.

If you want to buy a coin that is not accessible by direct purchase, you can buy USDT (stablecoin tied to the US Dollar), then trade it on the market for the cryptocurrency you want.

Only partial KYC verification required: Some crypto exchanges require a lengthy verification process that includes sending photos of your identification, photos of yourself, and even voice and video recording of your face, just to be able to use the platform. On KuCoin, you only need partial verification so you can maintain your privacy, and get started on the platform quickly. Full verification is only requested if there is suspicious activity, or if you want to withdraw more than 5 BTC in a 24 hour period. If you prefer complete anonymity when trading, you can see my list of the best anonymous crypto exchanges where no KYC is required.

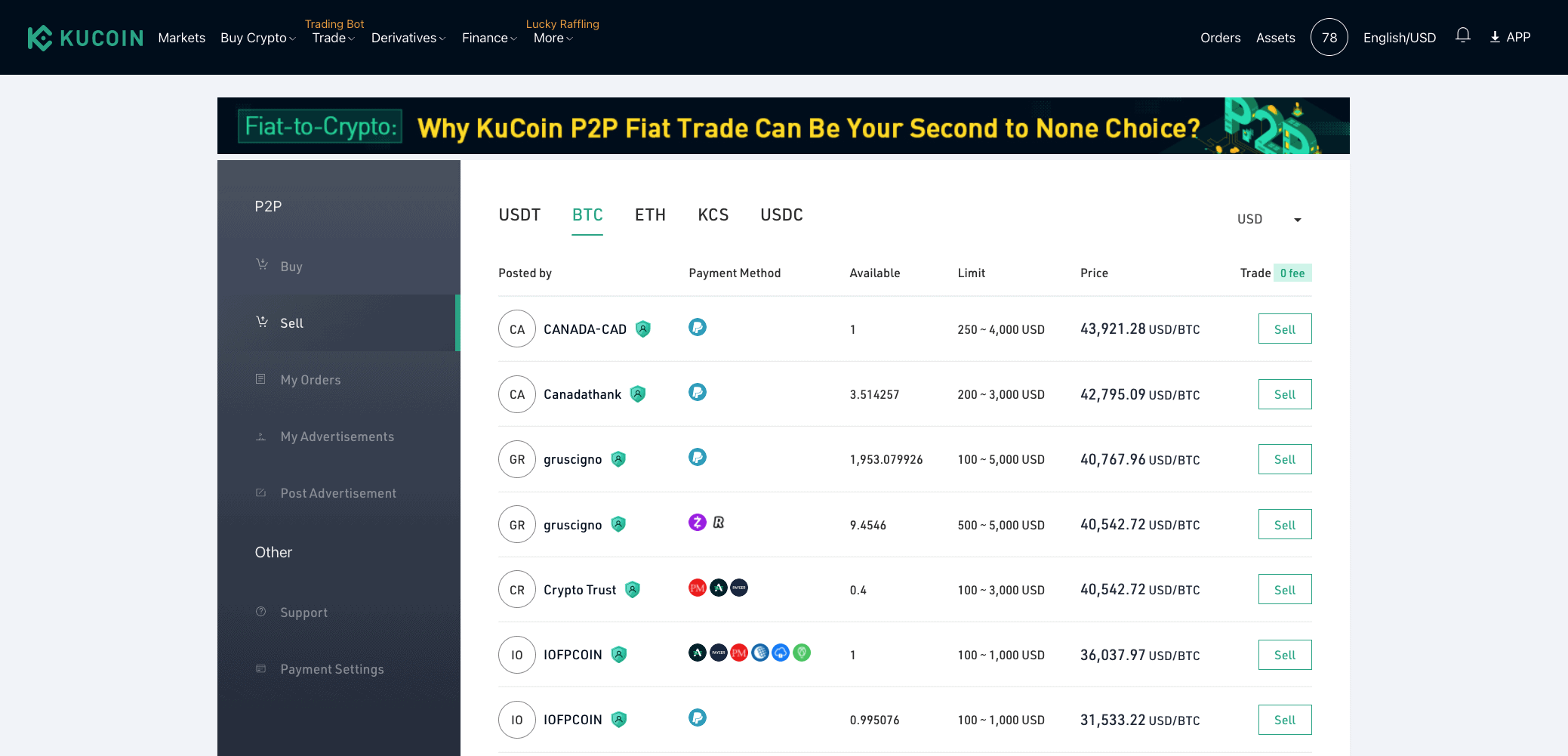

P2P marketplace - buy & sell with ZERO fees: KuCoin has a P2P (peer-to-peer) marketplace where you can buy or sell cryptocurrency with another user at an agreed price. You can advertise how much you are willing to buy or sell, and if another individual accepts your offer, your deal is complete and you make the trade. You can also browse the existing ads to see if there are any offers you wish to take. When I tested out the P2P market, I found someone to buy my BTC in less than 30 minutes, and I can confirm that no fees were charged by KuCoin for this service.

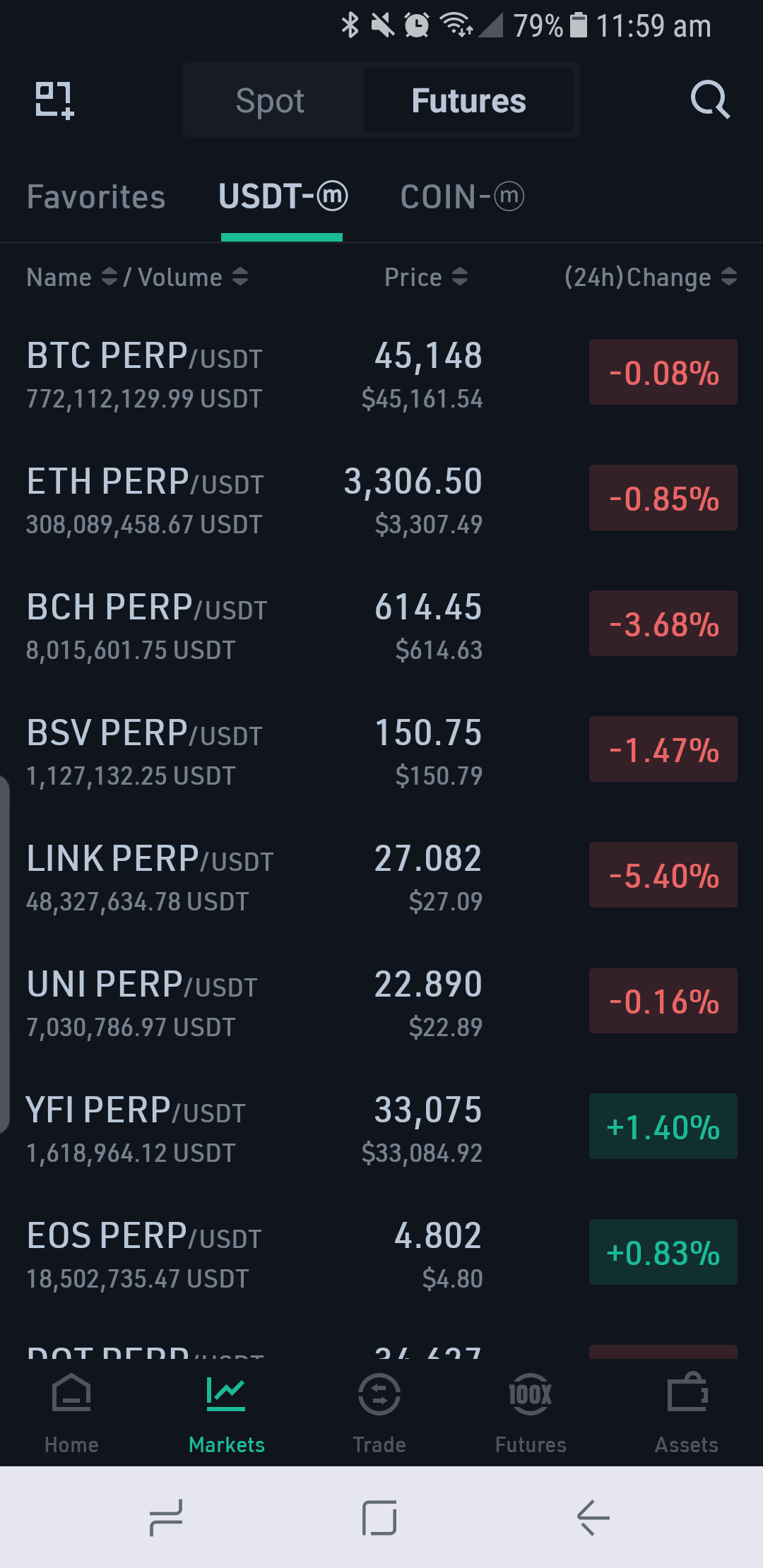

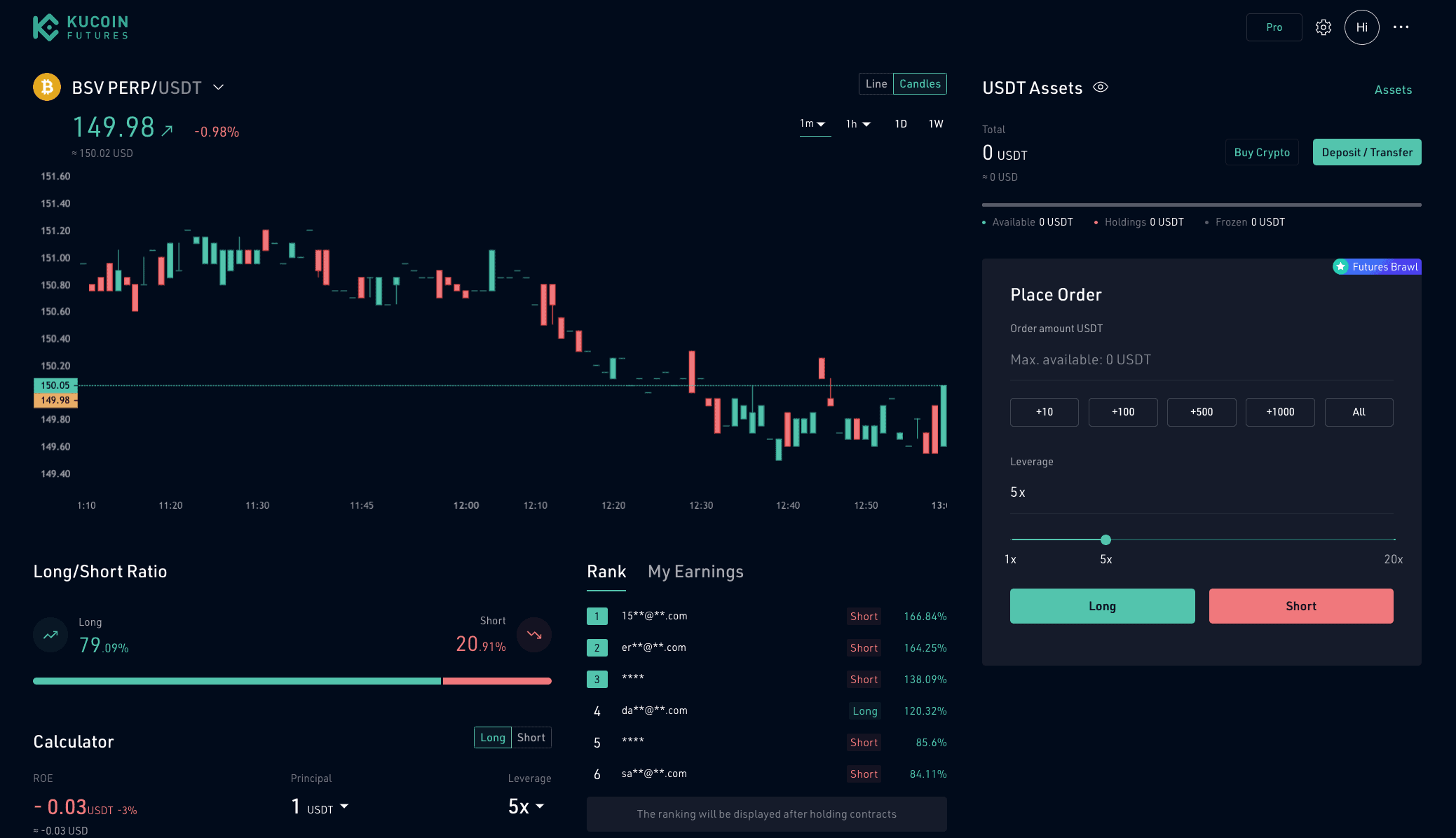

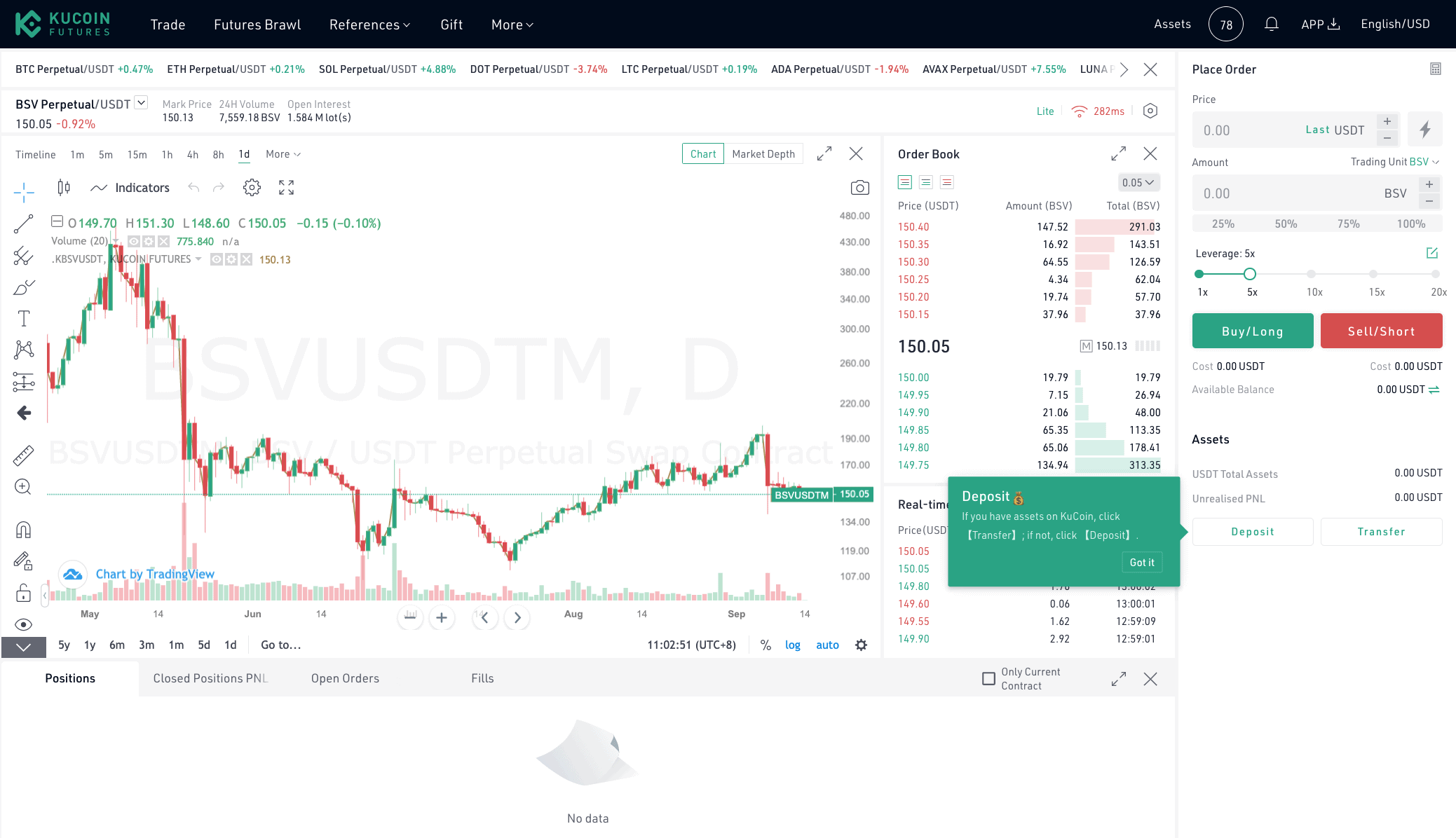

Futures and margin trading: KuCoin offers futures trading with up to 100x leverage. There are two interfaces you can choose from when trading futures. The first is called Futures Lite which is simple to use, and is perfect for a quick futures trade (see screenshot below). The second option is Futures Pro, which has full trading tools and supports up to 100x leverage. There is a screenshot of Futures Pro underneath the screenshot of Futures Lite.

Please note that margin trading is very risky, as you can lose more than your initial capital. Remember that cryptocurrency can be extremely volatile, and I do not recommend margin trading to anyone that is inexperienced.

KuCoin bonus - earn KCS daily: Any user that holds more than 6 KCS coins (KuCoin's native token) on the exchange can earn money from it, much like earning interest in the bank on a savings account. The bonus is given as a daily reward, and comes from 50% of KuCoin's trading fee revenue.

Another advantage of buying KCS is to use it to reduce your trading fees by 20%. Instead of paying 0.1% for spot trading, if you pay fees using KCS the fees are only 0.08%. I found it beneficial to buy lots of KCS, as I can use it reduce fees as well as earn daily interest.

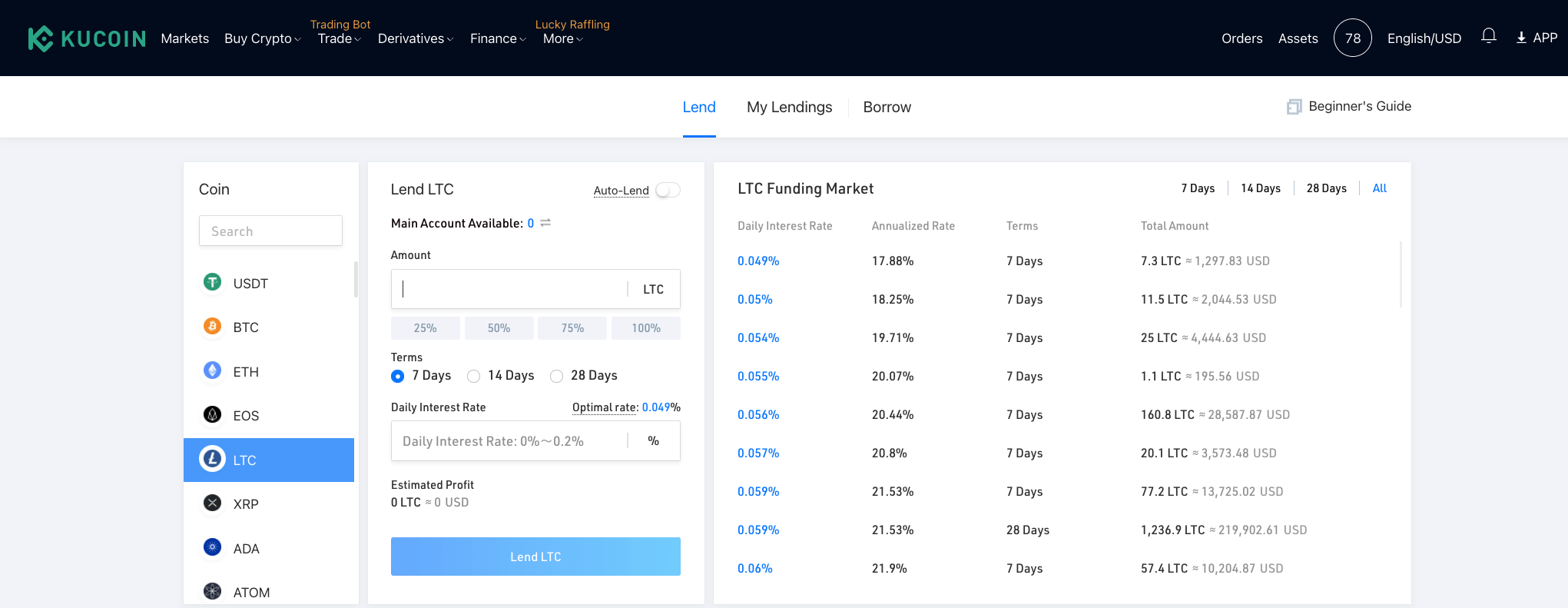

Crypto lending and borrowing: Another way you can earn interest on your crypto is to lend it to others on the KuCoin platform. There are over 160+ different cryptocurrencies that you can lend, and you can choose a term of 7, 14 or 28 days. The daily interest rate depends on the amount of interest you want to charge. The higher your interest rate, the greater your returns, but it's less likely someone will accept your offer if there are lower rates advertised by others. From my experience in the crypto industry, lending USDT is a steady way to earn interest without worrying about volatility in the crypto market, as the price of USDT remains stable.

If you are looking to borrow crypto, you can also do that on KuCoin. Simply select which coin you want to borrow, the amount, and the daily interest rate that suits you.

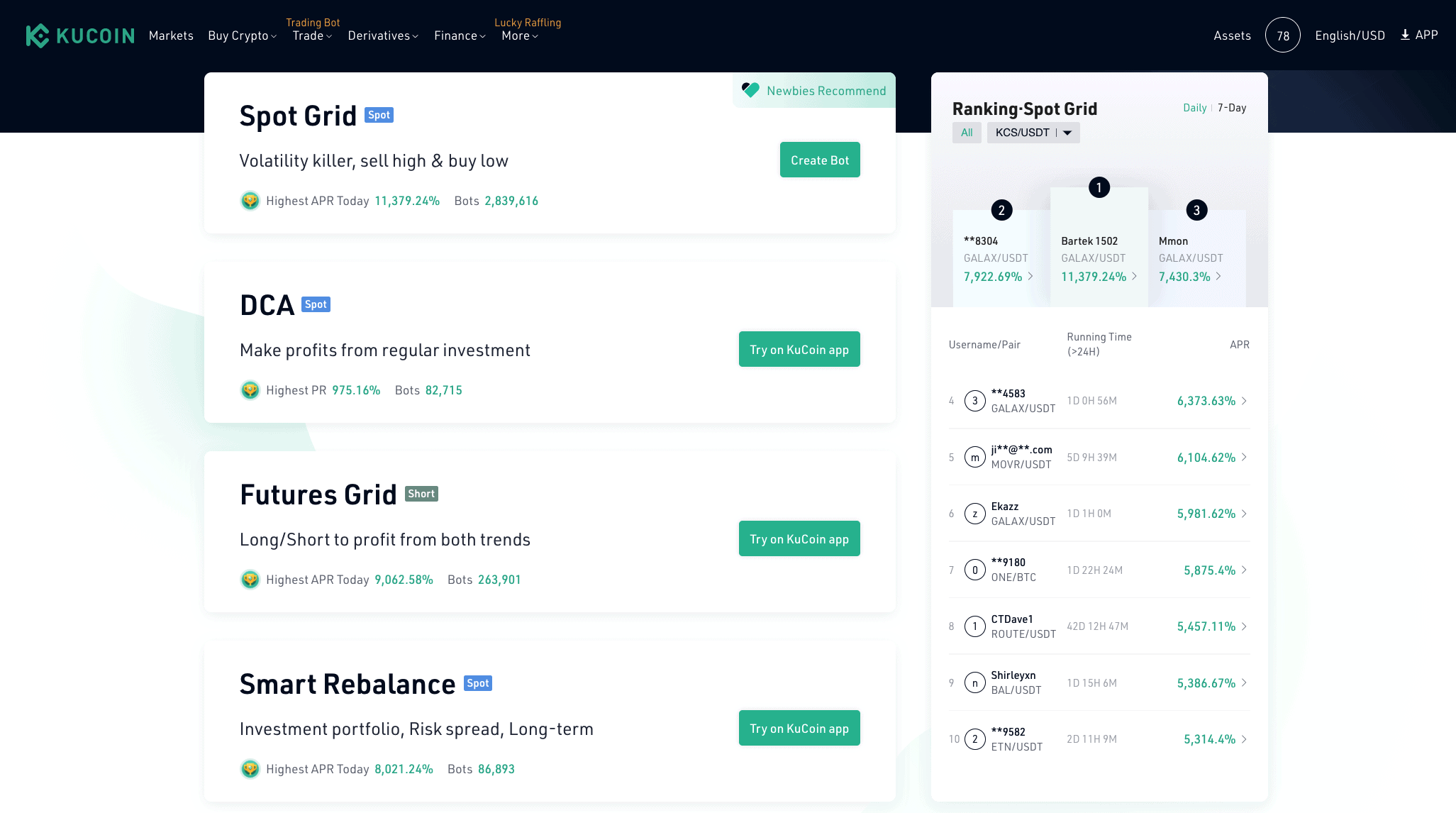

KuCoin trading bot: A Trading Bot is a really useful tool that can increase your investment profits by automating your trading strategy. While some crypto exchanges link up to third-party trading bot software, KuCoin has incorporated several free bots directly into their platform. Simply select the rules that your bot will follow, and the trades will be executed automatically, so you can trade even while you sleep.

The bots operate on a cloud, so there is no need to have your phone or computer running at all times. It was easy to set up my own bot and I was quite pleased with the results after running for a week. If you prefer, you can also browse the most successful bots on KuCoin, and copy their configurations to create the same bot on your own account.

Bank-level asset security: Safety is paramount when it comes to cryptocurrency exchanges, and when you trade on KuCoin, you can rest assured your funds are safe. The exchange implements many security measures, such as micro-withdrawal wallets, industry-level multilayer encryption and dynamic multi-factor authentication. This runs alongside their dedicated internal risk control departments who overlook all transactions on a daily basis. KuCoin was hacked in 2020, but they managed to recover a large portion of the funds. The unrecovered funds were covered by their insurance, so users did not suffer any losses in this cybersecurity breach.

After the FTX collapse in late-2022, many users may be wary to place their trust in a crypto exchange again. I did some research and discovered that KuCoin has Proof of Reserves from third-party institutions, as well as independent periodic verification, where users can verify their own asset data. There is no need to worry about your assets being frozen, as there is always enough for every user to withdraw.

What I Don't Like About KuCoin

As mentioned above, there are a couple of disadvantages that I came across when testing out KuCoin. Whether these are non-issues or dealbreakers will depend on your personal circumstances.

No fiat withdrawals: Like many dedicated crypto trading platforms, KuCoin doesn't have an option for users to withdraw fiat currencies. It is built for cryptocurrencies only, and this can be a problem when you want to sell your crypto for fiat. However, most traders don't find this a major issue, since it is easy to send your crypto to another exchange that supports fiat withdrawals. If you are unfamiliar with this, follow my step-by-step guide on how to withdraw money from KuCoin to your bank account.

To purchase crypto using fiat, there are high fees involved: While trading fees on KuCoin are low, if you don't own crypto and you need to purchase some, the fees are high. This is due to the fee charged by the third-party processor, which is around 3% to 5%.

KuCoin Fees

KuCoin charges different fees for depositing, withdrawing, trading and purchasing cryptocurrency; I will go into detail below.

KuCoin Deposit Fees

There are zero fees for depositing cryptocurrency into KuCoin.

KuCoin does not support fiat deposits. However, if you want to buy crypto with fiat, you can do so at the time of purchase, without pre-funding your account.

How much is the fee to buy crypto on KuCoin?

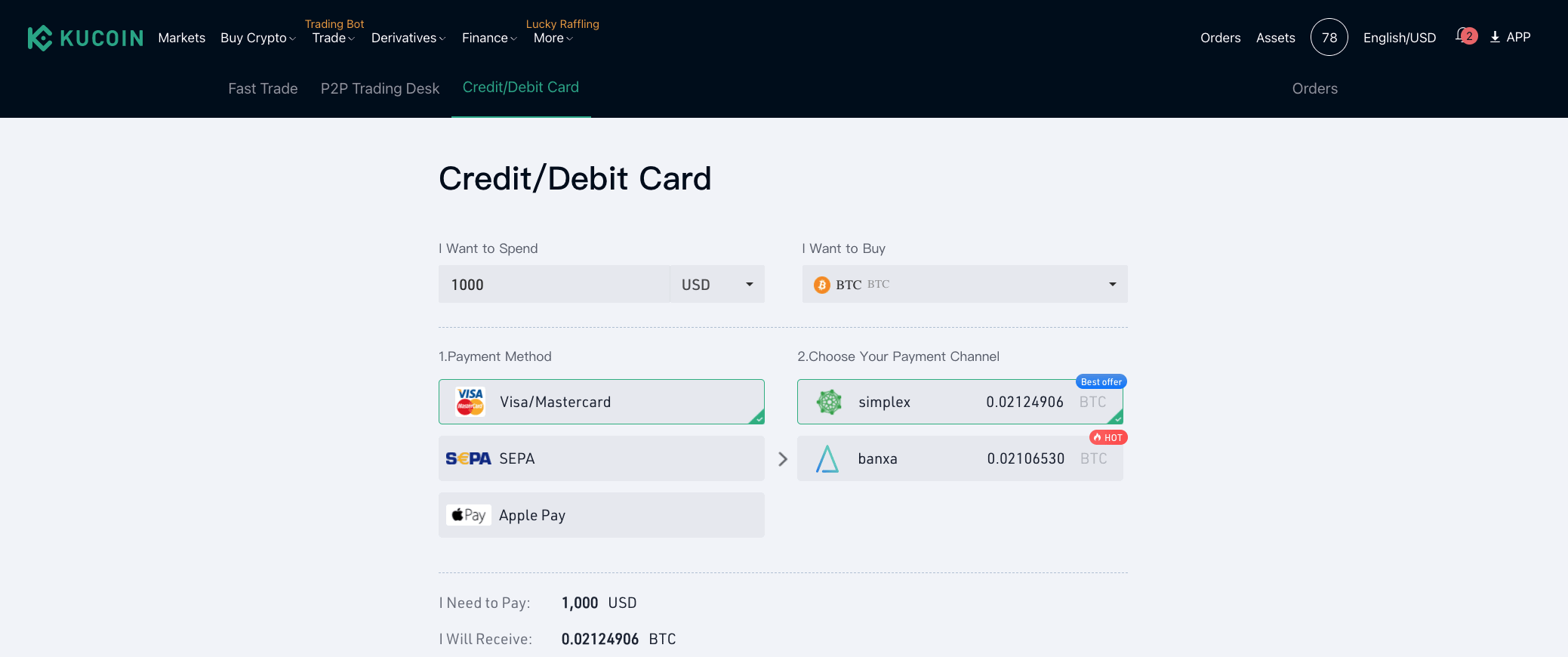

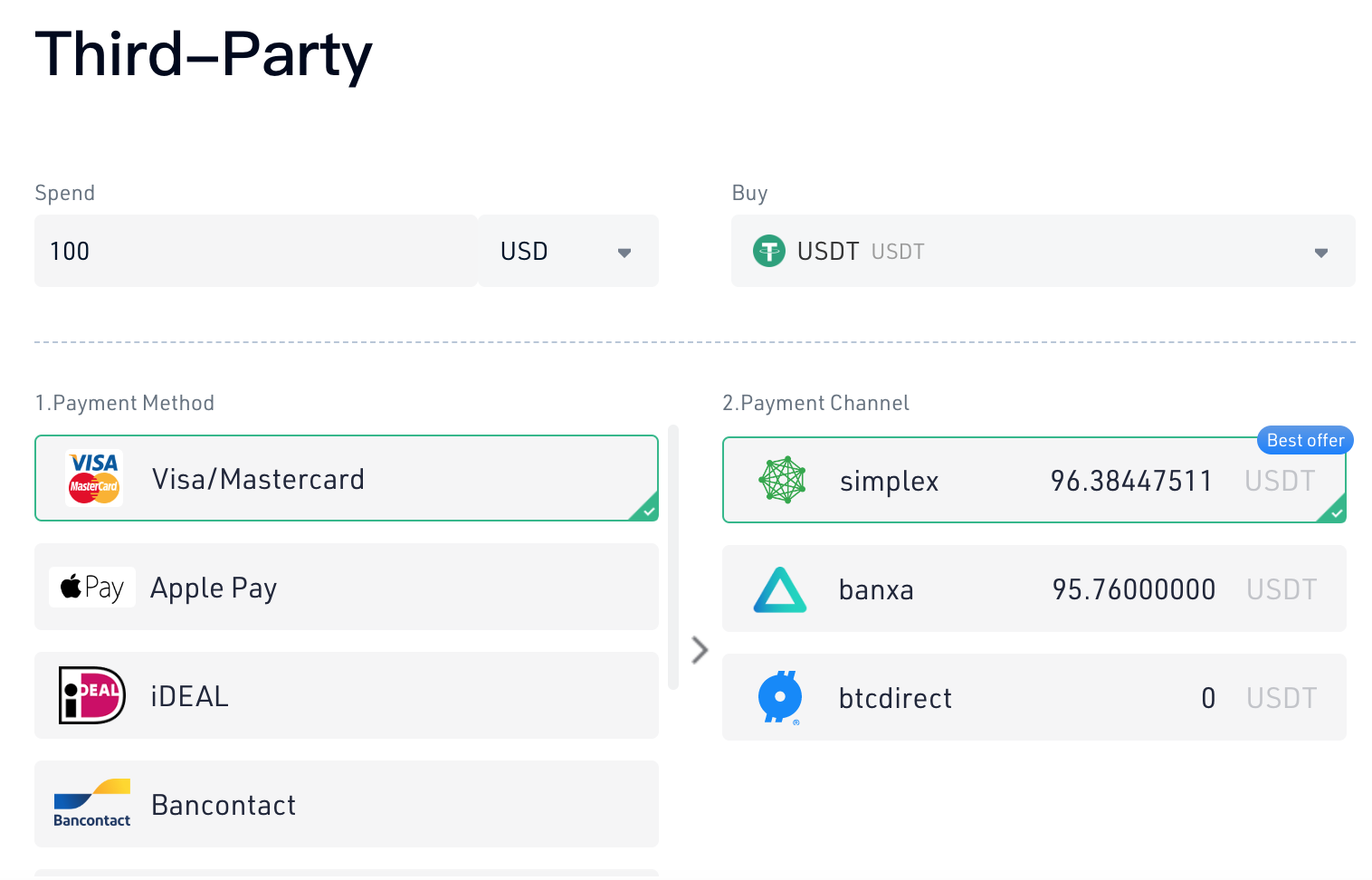

I spent hours researching this fee, and there were no clear answers on KuCoin's website, nor any third-party reviews. So I decided to work out the fee myself. To do this, I purchased USDT using US Dollars on my KuCoin account. Since USDT is the same value as the US Dollar, the difference in what I pay, and the amount of USDT I receive will show the fee that is taken out. As you can see from the screenshots below, depending on the payment method and the payment channel, the fees will vary.

The best value appears to be Visa/Mastercard using Simplex, where you receive 96.38 USDT for $100. This means the fee is about 3.62%. If you use Banxa, the fee is higher, at around 4.24%.

KuCoin Withdrawal Fees

When you withdraw cryptocurrency from your KuCoin account, there is a flat fee that varies depending which coin you are transferring. You can see the full list of KuCoin's cryptocurrencies and their respective withdrawal fees on their website. Also be aware of the daily withdrawal limits on KuCoin, which vary based on your verification level.

KuCoin does not support fiat withdrawals, but you can follow the steps in my article here to get your money from KuCoin to your bank account.

KuCoin Trading Fees

KuCoin fees for spot trading start at a low 0.1% and you can easily access a 20% discount if you use KCS coin (Kucoin's token) to pay your fees. This equates to only 0.08% per trade.

Trading fees compared against other popular exchanges

KuCoin | Binance | Coinbase | Bybit | |

|---|---|---|---|---|

Trading Fees | 0.08% | 0.10% | 4.5% | 0.10% |

If you are a large-volume trader (based on last 30 days) or you hold a lot of KCS, you can access even greater discounts, shown in the table below. At the highest rate of discount, Makers actually receive a rebate of 0.005% (they are paid to trade), and the Taker's fee is only a tiny 0.02%.

KCS Holding | Trade Volume (BTC) | Maker/Taker | KCS Pay Fees (Maker/Taker) |

|---|---|---|---|

0 | <50 | 0.1%/0.1% | 0.08%/0.08% |

1,000 | >50 | 0.09%/0.1% | 0.072%/0.08% |

10,000 | >200 | 0.07%/0.09% | 0.056%/0.072% |

20,000 | >500 | 0.05%/0.08% | 0.04%/0.064% |

30,000 | >1,000 | 0.03%/0.07% | 0.024%/0.056% |

40,000 | >2,000 | 0%/0.07% | 0%/0.056% |

50,000 | >4,000 | 0%/0.06% | 0%/0.048% |

60,000 | >8,000 | 0%/0.05% | 0%/0.04% |

70,000 | >15,000 | -0.005%/0.045% | -0.005%/0.036% |

80,000 | >25,000 | -0.005%/0.04% | -0.005%/0.032% |

90,000 | >40,000 | -0.005%/0.035% | -0.005%/0.028% |

100,000 | >60,000 | -0.005%/0.03% | -0.005%/0.024% |

150,000 | > 80,000 | -0.005%/0.025% | -0.005%/0.02% |

If you trade Futures on KuCoin, the fees are even lower, at 0.02% for makers and 0.06% for takers. While you cannot receive discounts by paying in KCS, you will receive discounts based on trading volume from the previous 30 days.

Pros and Cons of KuCoin

- Large crypto exchange with over 30 million users worldwide

- Extremely low spot trading fees of 0.1% with a further 20% discount if you pay with KCS

- Mobile app available for iOS and Android

- Over 700+ cryptocurrencies available

- Additional features such as crypto lending, trading bots, margin trading, futures trading

- High fees when buying crypto with fiat (3%-5%)

- Cannot withdraw fiat currencies

The Verdict

KuCoin is one of the most popular cryptocurrency exchanges, and after reviewing it, I can understand why. In fact, it is now one of my main crypto trading platforms. KuCoin's low trading fees, P2P marketplace with no fees, wide range of 700+ cryptocurrencies, and additional features like trading bots, futures, margin trading, and crypto lending make it one of the most comprehensive crypto exchanges.

A couple of downsides to KuCoin is that purchasing crypto using fiat involves a 3-5% fee, and you also cannot withdraw fiat currency from the exchange. KuCoin may not be ideal for those who are looking to buy and hold crypto for the long-term, but it is well-suited for crypto traders.

If you are looking to compare other options, MEXC is another popular crypto exchange with plenty of features. You can read my full review of MEXC and I also have an article comparing KuCoin to MEXC.

Frequently Asked Questions

Yes, KuCoin is a legitimate and reliable cryptocurrency exchange that was founded in 2017. It has expanded rapidly in recent years and now serves over 20 million users.

Yes, KuCoin is a safe cryptocurrency exchange. You can trade comfortably on KuCoin, knowing that your digital assets are secure on the exchange. KuCoin utilizes several layers of security, including micro-withdrawal wallets, industry-level multilayer encryption and dynamic multi-factor authentication. They also have dedicated internal risk control departments who overlook all transactions on a daily basis.

Yes, KuCoin is a trusted cryptocurrency exchange established in 2017 and used by over 20 million customers around the globe. It uses multi-layered security, including micro-withdrawal wallets, industry-level multilayer encryption and dynamic multi-factor authentication. KuCoin even has internal risk control departments overseeing all the transactions made each day.

It doesn't matter how secure a crypto exchange is, there is always the chance that hackers find a vulnerability. KuCoin was hacked in 2020, but the important issue is how they dealt with it. KuCoin managed to recover a large portion of the stolen cryptocurrencies, and the remaining unrecovered funds were covered by their insurance policy. KuCoin users did not lose any money as a result of this cybersecurity breach.

Yes, KuCoin is available to US residents. You won't be able to access the KYC verification, but this is not required. You can still use the platform without full verification.